capital gains tax india

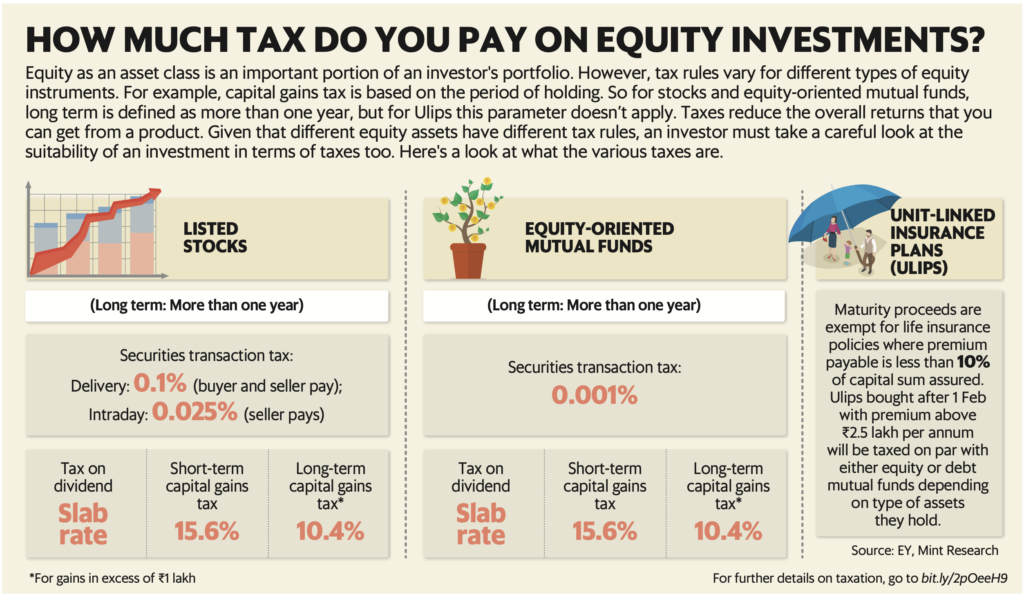

Akin to Section 112A Section 111A specifies the rate of capital gain tax to be 15 plus applicable surcharge and cess on the gains arising from the. Web Capital gains tax is complicated for a few primary reasons.

How To Disclose Capital Gains In Your Income Tax Return Mint

Type of Capital Asset.

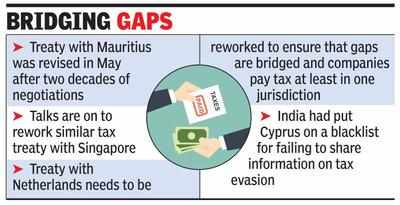

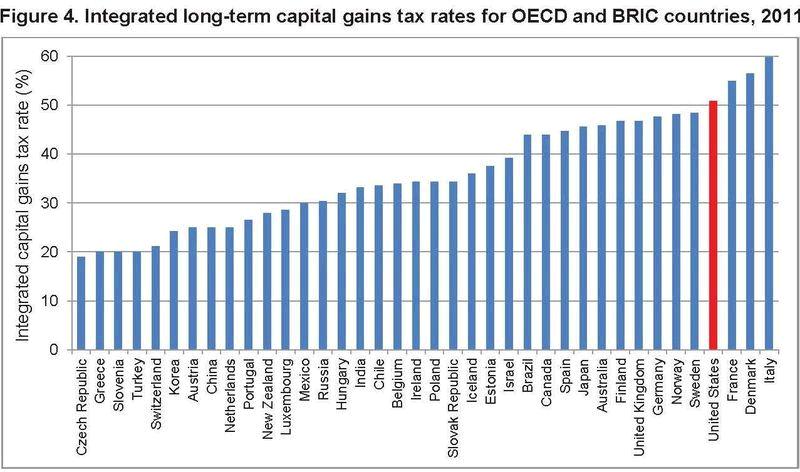

. Web To pay capital gains tax you can first calculate the applicable tax on your profits by selling or redeeming assets. Web The tax authorities are undertaking a comparative analysis of Indias capital gains taxation regime with that of other countries with an eye on possible modifications in. First the rate changes from asset to asset.

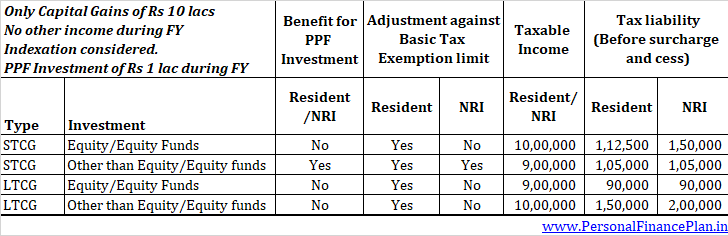

Web Short term capital gains are taxed according to income tax slab rates of the NRI which is based on the total income taxable in India. Board of India Act 1992 will always be treated as capital asset hence such securities cannot be treated as stock-in-trade. Currently the Short Term Capital.

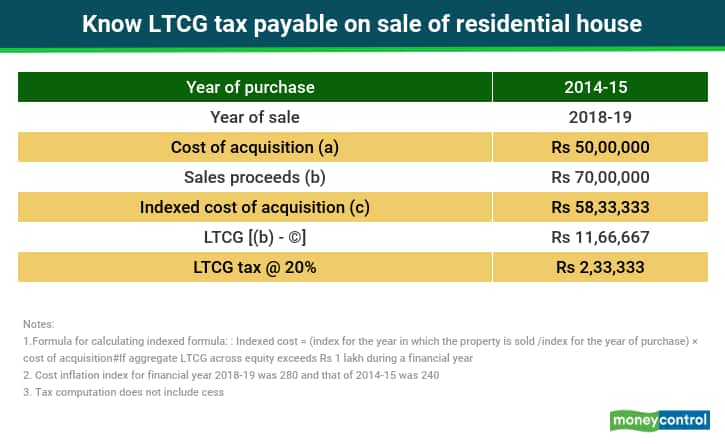

As per Indian tax law following surcharge is also. Web 2 days agoGains arising from sale of immovable property and unlisted shares held for more than 2 years and debt instruments and jewellery held for over 3 years attract 20 per. Web India taxes investment gains based on a lock-in or holding period.

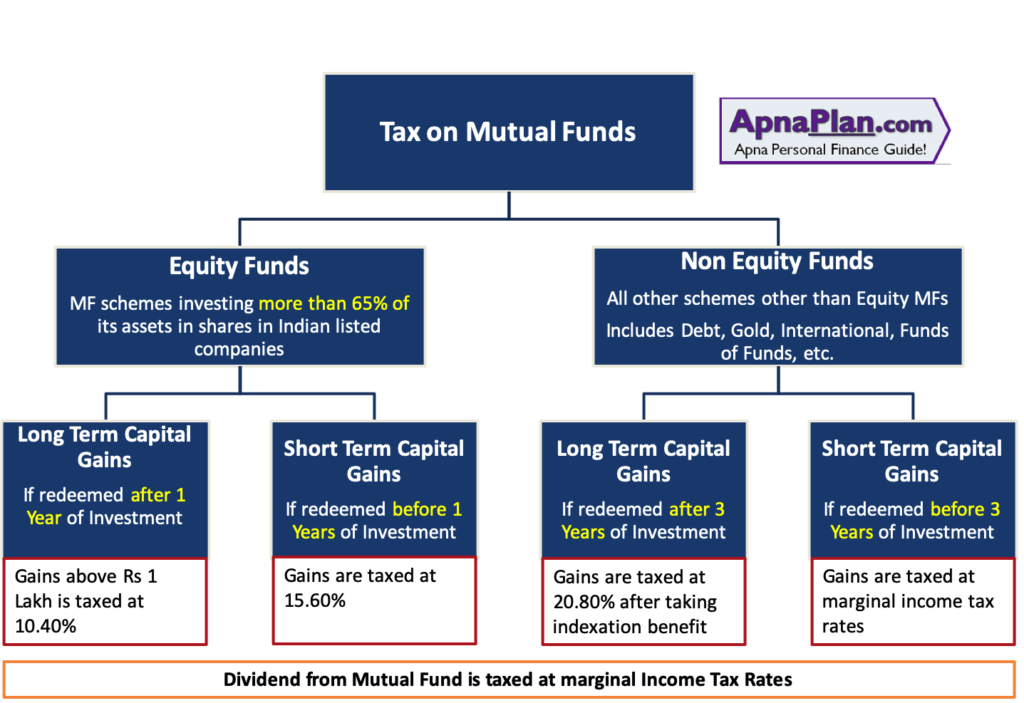

Investments in equity or equity-linked mutual funds for more than one year are. Web The capital gains tax in India under Union Budget 2018 10 tax is applicable on the LTCG on sale of listed securities above Rs1 lakh and the STCG is taxed at 15. Web But with the announcement of the new Budget 2022 it is capped at 15.

Web The finance ministry is looking at rationalising long-term capital gains tax structure by bringing parity between similar asset classes and revising the base year for. Web Some of the very important points that a seller of property must know with respect to capital gains tax are. You can follow these steps for calculation.

Tax saving us 80C to 80U is not allowed to Capital gains. Web Capital gains tax in India Important rules to be aware of. Web Just like STCG LTCG has also two different two different tax rate slabs for different asset categories.

Tax Rate on Long-Term Capital Gains Tax Rate on LTCG Upon the sale of shares or units of equity. Long term capital gains are. Gains arising from sale of immovable property and unlisted shares held.

Web India is planning changes to its capital gains tax structure in the next budget seeking to bring parity among tax rates and holding periods for investments. Web You cannot completely avoid capital gains tax in India. Web Long term capital gains tax LTCG Tax Long term capital gains are taxed at a flat rate of 20 Though STCG and LTCG are taxed at the above-mentioned rates in.

Web Gains arising from sale of immovable property and unlisted shares held for more than 2 years and debt instruments and jewellery held for over 3 years attract 20 per. Web From the year 2019 the criteria have been updated for the immovable property such as plot house commercial spaces etc. LTCG tax on stocks and equity mutual funds is 10 but on.

Assessees can get tax benefits on long-term capital gain from the sale of property if they invest the profit for the purchase of house properties. 1 Identify your long-term. Tax Breaks under section 80c to 80U is not available to.

Web TAX ON LONG-TERM CAPITAL GAINS Introduction. Web 1 day agoCurrently shares held for more than one year attract a 10 tax on long-term capital gains. Web Tax exemptions us 54.

Web Section 111A. However for assets like real estate properties you can avail of tax benefits by complying with Section 54 Section 54B and.

What S New In Capital Gains Tax For 2018 19 Income Tax Refunds

Nri Corner Capital Gains Tax For Nris Personal Finance Plan

Understanding Long Term And Short Term Capital Gains

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

The Long And Short Of Capitals Gains Tax

Capital Gains Tax The Long And Short Of It Mymoneysage Blog

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Everything To Know About Capital Gains Tax Vakilsearch

Investments Via Cyprus To Attract Capital Gains Tax Times Of India

Nangia Andersen India Pvt Ltd In News It Dept Notifies New Rules For Capital Gains Tax Exemption Nangia Andersen India Pvt Ltd

Mint On Twitter Govt Plans Reform In Capital Gains Tax India Is The Fastest Recovering Economy Says Chandrasekhar Cpi Inflation Stays Above Rbi Tolerance Level In February Read The Latest

Mutual Funds Taxation Rules Fy 2020 21 Capital Gains Dividends

.jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

How To File Itr Ay 2021 22 On Sale Of Shares Income Tax Return Capital Gains Tax I Ca Satbir Singh Youtube

International Capital Gains Tax Rate Comparison Where Does The Us Stand Topforeignstocks Com

How Does Long Term Capital Gains Tax Work Quora

Do You Know How Tax On Mutual Funds Impact Your Returns Fy 2021 22 Apnaplan Com Personal Finance Investment Ideas