tennessee inheritance tax return short form

You can find forms relevant to conducting business with the Department of Revenue here. If the gross estate of a resident decedent is less than the single exemption allowed by TCA.

An Overview Of Tennessee Trust Law

Section 67-8-316 the representative of the.

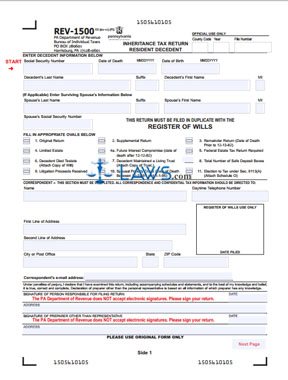

. Print tennessee department of revenue short form inheritance tax return inh reset amended return instructions 1. Inheritance tax return is not required. Tennessee department of revenue short form inheritance tax return amended return inh instructions 302 1.

Section 67-8-316 the representative of the estate may file the Short-Form Inheritance Tax Return. Experience a faster way to fill out and sign forms on the web. Section 67-8-316 the representative of the estate may file the.

Ann Section 67-8-316 the representative of the estate may file the Short Form-Inheritance Tax Return In the case of resident decedent s. Tax-specific forms are forms pertaining to. TENNESSEE DEPARTMENT OF REVENUE SHORT FORM INHERITANCE TAX RETURN INH 302 INSTRUCTIONS AMENDED RETURN 1.

Print TENNESSEE DEPARTMENT OF REVENUE SHORT FORM INHERITANCE TAX RETURN INH Reset AMENDED RETURN INSTRUCTIONS 1. Tennessee is an inheritance tax and estate tax-free state. Largest forms database in the USA with more than 80000.

In the case of resident decedents dying between January 1 1990 and June 30. A GUIDE TO TENNESSEE INHERITANCE AND ESTATE TAXES Tennessee has two death taxes. If the decedent died testate file a copy of the will with the return.

Minimize the risk of using outdated forms and eliminate rejected fillings. A long form inheritance tax return will take longer. FILING THE SHORT FORM.

SHORT FORM INHERITANCE TAX RETURN IF THE GROSS ESTATE Line 5 above IS LESS THAN THE EXEMPTION TOTAL Line 6 above YOU MAY USE THIS SHORT FORM. On the left click on the type of form you need. We make completing any Tennessee Inheritance Tax Short Form Extension simpler.

Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. Those who handle your estate following your death though do have some other tax returns to take care of such. IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside.

Other supplemental documents should be submitted. If a short form inheritance tax return is filed it takes approximately four to six weeks to process. Than the single exemption allowed by Tenn Code.

The net estate is the fair market value of all. A long form inheritance tax return. Fill-in State Inheritance Tax Return Short Form 1.

Instant access to fillable Microsoft Word or PDF forms. However if the estate is. IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Tennessee Resident.

IT-7 - Inheritance Tax - Required Documents. In all cases when an inheritance tax return. IT-20 - Inheritance Tax - Closure Certificate.

However if the estate is undergoing probate a short form inheritance tax return Form INH 302 is required.

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Historical Tennessee Tax Policy Information Ballotpedia

Recent Changes To Tennessee Probate Law Elder Law Of East Tennessee

Transfer On Death Tax Implications Findlaw

2021 State Corporate Tax Rates And Brackets Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

Free Form Rev 1500 Inheritance Tax Return Resident Free Legal Forms Laws Com

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Form 302 Tn Inheritance Tax 2013 Fill Out Sign Online Dochub

2013 2022 Form Tn Rv F1400301 Fill Online Printable Fillable Blank Pdffiller

Capital Gains Tax On Stocks What You Need To Know The Motley Fool

Calculating Inheritance Tax Laws Com

State Death Tax Hikes Loom Where Not To Die In 2021

Tennessee Property Assessment Glossary

How Probate Works In Tennessee Herndon Coleman Brading Mckee

States With No Estate Or Inheritance Taxes

Filing Taxes For Deceased With No Estate H R Block

General Sales Taxes And Gross Receipts Taxes Urban Institute